Defining & Measuring Customer Acquisition Cost Within Affiliate Marketing

With 44% of companies placing a focus on customer acquisition—in contrast to the 18% of companies placing customer retention as their focus—advertisers are looking for ways to cost-effectively attract new customers. However, customer acquisition can cost up to 7 times more than selling to existing customers. To help brands understand how to accurately measure their customer acquisition cost and strategically implement a plan based off those metric insights, we laid out everything advertisers need to know about customer acquisition costs, specifically within affiliate marketing.

What is customer acquisition cost?

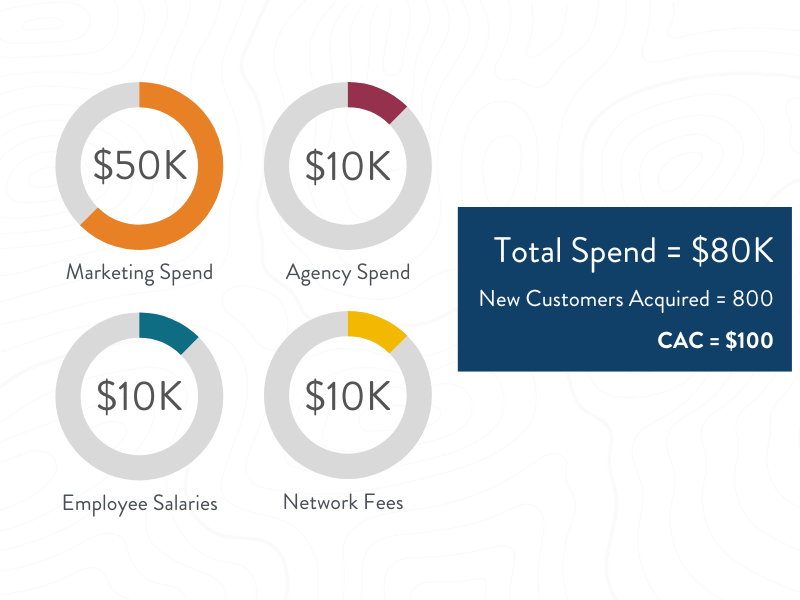

Customer acquisition cost (CAC) is a metric used to assess the cost a business incurs to acquire a new customer. It’s typically expressed as an average, with the total marketing campaign spend divided by the total number of acquired customers to get the average cost per new customer. Businesses will often calculate CAC by marketing channel to compare acquisition costs of various channels.

Understanding CAC metrics

In a sense, CAC can be viewed as the all-in cost per action (CPA) for your brand. It accounts for all marketing spend, as well as any additional costs your business incurs to acquire a new customer. These additional costs could be agency spend, employee salaries, gifting costs, technology stack, network costs, etc. It’s important to note that CAC should not include sales tax.

Before diving into best practices around using CAC, consider how you are using the term internally—it’s critical that you have alignment within all your marketing channels and partners on exactly which metrics you are including in you CAC calculations, as the exact inputs that are included in CAC can vary from business to business.

The graphic below includes an example of monthly costs that could be considered in CAC and a sample calculation:

Ensuring new customer revenue exceeds customer cost

Comparing customer acquisition cost against a user’s lifetime value or against a target payback period will help your business be able to assess your profitability levels. It’s important for any company to ensure that the revenue generated per customer exceeds the cost spent to acquire a customer, and the faster a company can recoup their acquisition costs, the better.

It’s also important to note that companies often have different goals when looking at CAC. While some companies may target an overall level of return, others may target a payback period of a specific length of time, or some may even look at a combination of variables.

At Acceleration Partners, we realize the value of being able to take a customized approach to analyzing CAC and implementing a calculated partnership strategy based off our learnings. Our ideal scenario for a business is to help them decrease CAC while increasing their customer lifetime value (LTV). By doing this, we ensure the cost to acquire a new customer has decreased while the revenue generated per customer has increased.

Case Study Example: Learn how Acceleration Partners designed a pilot program for a B2B service provider that drove new customers who demonstrated strong lifetime value and exceeded goals.

Affiliate marketing offers better cost control

Most paid digital marketing channels—such paid social—operate on a pay-per-click model. Paying for actions earlier in the conversion funnel can actually cause CAC to increase if conversion rates are not stable, placing more risk on this form of advertisement.

Conversely, organic search can be a cost-efficient channel, as it’s essentially free aside from personnel and resource costs, often resulting in a low CAC. While cost-effective, the risk with organic search is having very little control over Google’s search algorithms. Brands can optimize their organic search efforts according to a set of guidelines provided by the most prominent search engines; however, they are not able to have any control over the search results, and core search engine algorithm updates can massively impact the performance of this channel.

Given its pay-for-performance nature, the affiliate channel has a much higher degree of control over its costs. Contrary to the shortcomings of other paid and unpaid channels, the affiliate channel has tools to optimize for both scale and efficiency, making it a reliable channel for companies to invest in that are interested in placing a stronger emphasis on the CAC metric.

How AP helps clients set goals around CAC

As previously mentioned, every brand is unique in the way they view CAC and leverage the metric to inform partnership strategy decisions. Because of this, Acceleration Partners takes a personalized approach to setting CAC goals with clients.

One vital conversation we have with our clients is understanding how much importance your company places on the CAC metric by asking some of the following questions:

- What is the CAC goal for affiliate? How does this vary from CAC targets for other channels and the business overall?

- How are your CAC targets established?

- What costs do you incorporate into CAC calculations?

- What platform and/or internal tools are you leveraging to calculate CAC?

- How frequently do you assess CAC by channel?

- How strong of an emphasis is being placed on CAC internally?

Acceleration Partners works hard to understand each of our client’s goals arounds CAC, thus giving our agency the opportunity to align our strategic recommendations to your brand’s individual goals.

Implementing CAC best practices

As brands continue to place a stronger emphasis on cost-management given our current economic climate, there are a few best practices we recommend every brand keep in mind to successfully meet their CAC goals.

- Account for upper funnel tactics when implementing CAC ceilings for the affiliate channel. It’s important to note that investment in upper funnel opportunities and flat fee placements can benefit your affiliate program. At the same time, CAC should always be considered as proposals and program strategies are prepared. The best way to boost partner performance and maximize efficiency is to identify CPAi optimizations wherever possible—this is something your affiliate marketing management agency can help your brand with.

- Share CAC metrics and calculations to ensure accuracy. If your brand is placing a strong emphasis on CAC and leveraging internal data and/or tools to calculate it, we strongly suggest giving your agency partner as much visibility as possible into your CAC metrics. On the flip side, data within affiliate networks will vary from data tracked across other internal or third-party tools that brands can use to track performance. Acceleration Partners can leverage network data to calculate directional indicators for CAC, as long as we get visibility into the numbers being used as the source of truth.

- Align CAC priorities with internal metric goals across marketing channels. In some scenarios, your brand might be interested in reaching a lower CAC to conserve and reallocate marketing spend. This particular strategy often impacts volume, but conversely increases profitability. Whatever your evolving goals might be, enlisting the help of an experienced affiliate marketing management agency will provide you with the goal-aligned support and transparent expectations needed to achieve your CAC KPIs.